We pledge to provide straight talk from our NNINS Virginia insurance experts. Read the Northern Neck Insurance Integrity Promise.

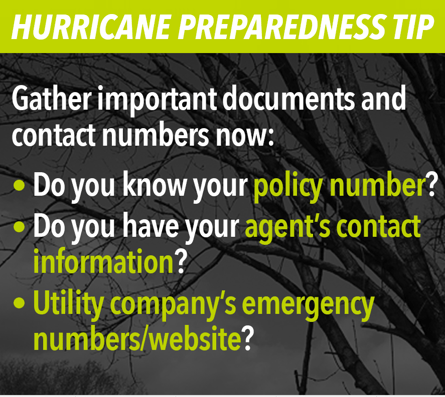

While this article will provide some general answers to frequently asked questions, it's important to remember that policies differ based on individual coverage choices. If you have coverage questions, the best time to call your local independent agent to review your home insurance and car insurance coverage is before a big storm is forecasted. Our local agent partners provide valuable insight into your specific situation and insurance choices. Then you can start to prepare your property.

Proper home preparation is the key

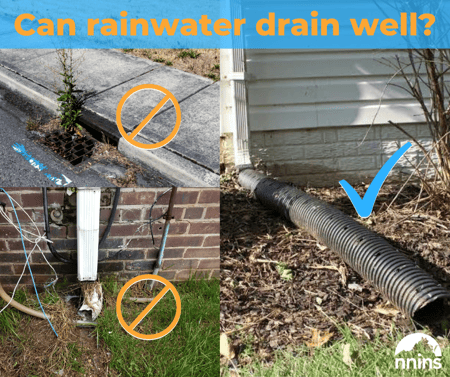

We are experts at helping you prepare your house for a hurricane. Start by making sure your neighborhood's storm drains, home gutters, downspouts, and extensions are free from blockages and allow large amounts of rainwater to drain well away from your foundation. Bring in home yard items such as trash cans, toys, tools, and planters, and secure furniture and a grill that may get damaged or cause damage.

Prepare for an insurance claim

We recommend that you have a personal home and property inventory. If it's last minute, snap a picture of each room of your home, basement, garage, and refrigerator contents. Your homeowners insurance policy may cover the cost of the food lost in your fridge if you experience an extended power outage.

When a big storm is forecasted, we prepare extra claims resources to help you with a home or car insurance claim. We're here around the clock from start to finish to give our members prompt claim services. Depending on the impact of a major storm, we can potentially be handling high volumes of claims; we appreciate your patience. You are important to us, and we will be making every effort to assist each claim.

Put safety first when a hurricane hits

We want to encourage you to put your safety and your family's safety above all. If you're preparing for a possible hurricane, use our interactive Hurricane Preparedness Guide to access informational links to the most reliable resources in Virginia. Also, be sure to have a family plan, get to know your neighbors, and check in on each other. Our Virginia communities are resilient and can weather the effects of any big storm together. Connect with us on Facebook, Twitter, and Instagram for real-time helpful information and tips. We have another great article on surviving severe weather chock full of helpful tips and links.

NNINS 24/7 Claims Hotline: 1-877-968-7252

What should you do immediately after hurricane damage?

Take these steps following damage to your home:

- Take great care when entering a damaged structure. If there is serious damage, contact local officials before entering.

- Report downed power lines or gas leaks. Keep electricity turned off if the building has been flooded.

- Contact your local independent agent.

- Call our hotline and report your claim or make an online claim through your online member account.

- Make minimal temporary repairs to prevent further damage. Document or keep damaged items. Turning on location services on your smartphone when taking photographs or video can help verify the location of your items for your claim.

- If your home is unlivable, find safe shelter with a friend, family member, or hotel.

- Keep all receipts for lodging, food, clothing, gas, and other necessities for reimbursement.

- Wait on permanent repairs for approval by your claims adjuster.

- Discuss claim questions with your local agent and NNINS claims adjuster. Write down the adjuster’s name, phone number and work schedule as soon as you have them.

Cleaning up after hurricane damage

Before starting the cleanup process, make sure it's safe. Wear gloves and protective eyewear.

- Do not wade through standing water.

- Avoid downed power lines and assume they are live.

- Use generators safely: If you're running a generator outside, keep it dry! Exposed electrical outlets pose a serious shock hazard in wet conditions. To avoid dangerous carbon monoxide poisoning, never run it in a garage, basement, or crawl space!

Hiring a contractor and avoiding fraud

We don't recommend hiring door-to-door contractors to visit your neighborhood. Scams are common after a major disaster. Fraud scams can include taking payment and then never completing the work, the use of inferior materials, and performing work that’s not up to code.

A contractor should not interpret the language of your insurance policy or discourage you from contacting your insurance company. Watch for people calling or coming to your door and saying they are with a national carrier. Do not provide personal information over the phone unless they can confirm a claim number. If something sounds fishy, report it to your insurance company immediately.

Here are a few more tips for hiring a contractor:

- Hire only reputable, recommended, insured, and licensed contractors.

- Get more than one estimate.

- Request references and do the research.

- Ask to see the salesperson’s driver’s license and write down the license number and their vehicle’s license plate number.

- Look out for out-of-state contractor licenses and vehicle registrations, as these may indicate possible fraudulent contractors.

- Avoid any pressure into making a quick decision or hiring them.

- Get everything in writing. Cost, work to be done, time schedules, guarantees, payment schedules, and other expectations should be detailed and itemized.

- Avoid signing a contract with blanks; terms you don’t agree with can be added later.

- Only pay a contractor in full or sign a completion certificate when the work is finished.

- If you suspect fraud, report it to the National Insurance Crime Bureau.

Hurricane coverage FAQs

Will my car insurance cover damage to my car if a tree falls on it?

The damages are covered if you have comprehensive car insurance minus your deductible. This coverage also includes flooding of your car.

How does home insurance cover hurricane damage?

Your home insurance coverage typically covers damage to your home and personal belongings from wind, water damage, tornadoes, lightning, trees, and hail. Hurricanes are considered "named storms." You may have a named storm deductible for a claim. That information is located on your policy documents.

Does a homeowners policy cover flood damage?

No, homeowners policy excludes flood coverage. Learn more about the difference between flood insurance and Inland Flood Coverage. Home insurance may pay for water damage to your home from a hurricane if it results from other damage, such as a tree falling on your house.

Does my neighbor's insurance pay for repairs if their tree falls on my house?

We often are asked this question and we have answers! The short answer here is you and your neighbor should report the damage to each of your insurance carriers and allow the adjusters to review the claim.

What if my home is not livable after damage? What should I do?

Call your local insurance agent and report your claim first. Take photos/videos of damage if possible. Then, if it's safe, secure the premises or hire a professional to make temporary repairs, such as boarding up windows, tarping the roof, etc., to prevent further damage.

Shingles can be easily damaged in hurricane winds. This can lead to water getting into your home. Be sure to check your attic for evidence of water staining or standing water.

Communicate with your agent and NNINS claims adjuster for further instructions. Be sure to keep all receipts for temporary living space, gas, food, clothing, etc. Use your home inventory to document damaged personal property. Hold onto any damaged property until instructed otherwise by your claims adjuster.

We hope you don't experience damage from a hurricane this year, but if you do, we'll help you get back on your feet. Most of all, stay safe! Never attempt to drive through flooded roads, and stay away from floodwater. Be safe, Virginia!

Learn more about homeowners insurance in Virginia >

THE NORTHERN NECK INSURANCE INTEGRITY PROMISE — We pledge to provide straight talk and good counsel from our NNINS Virginia insurance experts through our blog. While we hope you find this to be a helpful source of information, it does not replace the guidance of a licensed insurance professional, nor does it modify the terms of your Northern Neck Insurance policy in any way. All insurance products are governed by the terms in the applicable insurance policy.