Virginia and flash flooding

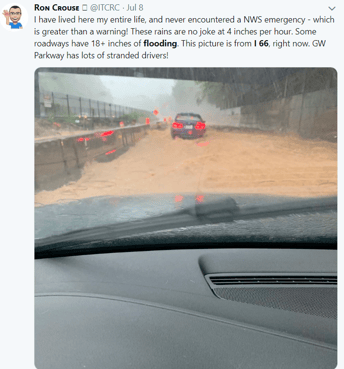

On July 8, 2019, flash flooding ravaged Northern Virginia, D.C., and Maryland. This historic deluge unloaded up to 4 inches of rain in some areas in 1 hour, causing historic flooding to major roads during the morning rush hour.

In September of 2021, 3.4 inches of rain in under an hour in central Virginia resulted in stunning flash flooding from the heart of downtown to I-95. Unfortunately, folks tend to take their chances and drive their cars through quickly flooding roadways. Never do this: turn around, don't drown!

The truth is that car flash flooding can happen anytime in Virginia from any prolonged or heavy rain event or from a hurricane or tropical storm. With peak hurricane season in mid-September, it's smart to plan ahead to prevent your car from flooding.

Does car insurance cover flooding?

The good news is that comprehensive car insurance can cover this type of damage along with damage from hail, fire, theft, fallen trees, and deer collisions. Comprehensive car insurance is separate from collision and liability coverage, so check with your independent agent to make sure you have it.

What should you do if your car floods?

Take the following steps if your car floods:

- If you were driving and the engine failed after going through floodwater, resist the urge to restart it. Doing so may cause further damage to the engine. Even if your car starts, you could experience mechanical problems days or even weeks after the event.

- If your car floods while parked, do not attempt to start it even after the floodwaters recede.

- Take pictures and provide them to your insurance carrier.

- If you have comprehensive coverage, you can call your insurance company and file a claim.

- Have your car towed to a reputable mechanic. Have your electrical system, oil, transmission components, and cylinders inspected.

- If your car's engine is repairable and water reaches your car's interior, it needs to be dried quickly to prevent mold growth. Speak to your mechanic about expediting this process.

What should you do if your electric vehicle floods?

There is a growing concern that is unique to coastal areas in Virginia and other hurricane zones — the spontaneous combustion of EVs and other battery-powered devices after storm surge and flooding. Hurricane Helene resulted in at least 64 lithium battery fires in Florida. EVs accounted for 17 of those but the rest were overheating and sometimes exploding lithium-ion batteries in golf carts, electric bikes and scooters and wheel chairs. Water conducts electricity and can a cause a short-circuit, which creates heat and potentially fire.

The threat of lithium battery fires can worsen damage to homes and buildings after floods and are difficult to extinguish. To prevent water damage to your EV when a storm or hurricane is forecasted, relocate them to higher ground or a protected parking area where flooding is not expected.

What if my EV or other battery-operated device is flooded?

If your electric car floods or device does come in contact with water, take fire safety precautions to avoid injury and property damage:

- Contact your manufacturer and follow recommendations for your specific vehicle.

- If the vehicle is being stored indoors, and can be moved, move it outside into an open-air location. If it cannot be moved, try to keep the storage area open and vented.

- Leave all windows and/or doors open to allow any potentially flammable gases to vent from the passenger compartment.

- Unplug and do not attempt to charge the vehicle.

- Disable the vehicle by chocking the wheels, placing the gearshift in park and removing the ignition key and/or disconnecting the 12V battery.

- Avoid contact with the HV battery especially if a vehicle is showing signs of a damaged or overheating HV battery.

NNINS 24/7 Claims Hotline: 1- 877-968-7252

How does a car insurance flood claim work?

After you've begun the claims process and a mechanic has inspected your car, the extent of the flood damage will be determined and provided to your car insurance carrier. You may have a rental car to use during that time if you added that coverage to your policy.

Your insurance adjuster will weigh the costs of making repairs against the value of your vehicle and your coverage limits. Depending on the type of car you have, its age, and its value, this type of damage can sometimes result in a total loss.

How can you prevent your car from flooding?

You can't always predict when something like this will happen, especially when it comes to sudden flooding. But you can avoid car flooding by parking your car on higher ground if heavy rain or hurricanes are forecasted. The best way to prevent car flooding is to avoid driving through any covered roadway, not only to prevent your car from getting damaged but, more importantly, for your safety.

Learn more about car insurance in Virginia

THE NORTHERN NECK INSURANCE INTEGRITY PROMISE — We pledge to provide straight talk and good counsel from our NNINS Virginia insurance experts through our blog. While we hope you find this to be a helpful source of information, it does not replace the guidance of a licensed insurance professional, nor does it modify the terms of your Northern Neck Insurance policy in any way. All insurance products are governed by the terms in the applicable insurance policy.