We pledge to provide straight talk from our NNINS Virginia insurance experts. Read the Northern Neck Insurance Integrity Promise.

At NNINS, we know two things: many Virginians are subject to the effects of flooding, and many believe their home is covered for flood damage by homeowners insurance. The fact is that standard home insurance policies do not cover flood damage. Let us explain, clear up any confusion, and help your family be as prepared as possible.

How Common is Flooding in Virginia?

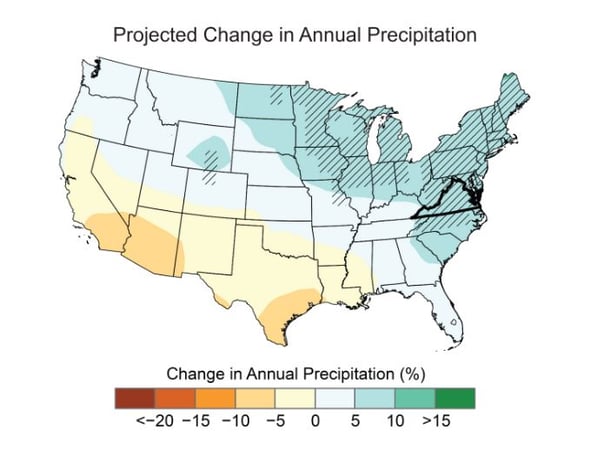

Flooding is the most common, destructive, and costly natural disaster in the United States. Southwest Virginia has faced five major floods in five years, causing severe damage to community lifelines. We witnessed extreme flooding in 2018, and it was the wettest year on record for dozens of towns and cities. 2020 was the third wettest year in the commonwealth (61.4 inches). December of 2023 alone produced a staggering 8.56 inches of rain throughout Virginia. Even as periodic droughts, a natural part of Virginia’s climate, are projected to be more intense, annual precipitation is projected to increase in Virginia.

“Broadly across Virginia … there seems to be a consensus that there is more water around, and that the storms are heavier and they dump more water when they come, and that’s a problem,” said Ann Phillips, the state’s special assistant to the governor for coastal adaptation and protection. “And that impacts people not every day, but often enough.”

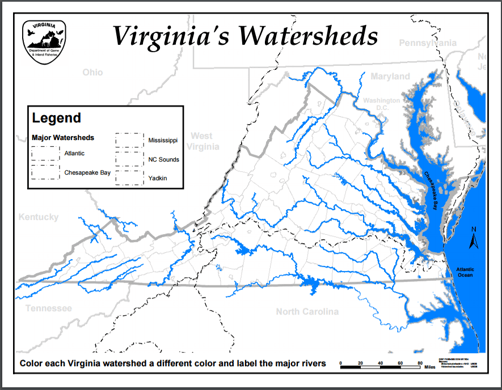

Southwest Virginia has faced five major floods in five years, causing severe damage to community lifelines.Flooding is a statewide hazard, from hurricane storm surges to mountain runoff and excessive rainfall. Virginians should learn how to protect their families and property before potential flooding. The most common exposures to flooding include living near bodies of water, especially low-lying areas, behind a levee, or downstream from a dam. Even tiny streams and low-lying ground that seem harmless in dry weather can flood from heavy sustained rainfall.

Virginia Watersheds Map courtesy of Virginia Department of Game and Inland Fisheries

Flood insurance programs

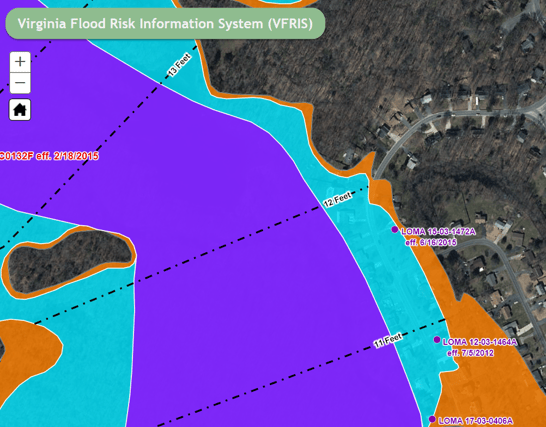

Congress acknowledged this growing weather issue and the shortcomings of traditional flood relief programs in 1968 and passed the National Flood Insurance Act, a federally backed program managed by the Federal Emergency Management Administration (FEMA). Today, the NFIP program provides separate flood insurance to U.S. property owners. Virginia's Flood Risk Information System (VFRIS) strives to develop accurate maps of flood hazard zones and improve floodplain management. You can use their handy map tool to locate and see if your property is within the Special Flood Hazard Area.

Do I need flood insurance for my Virginia home?

If you live in a flood-prone area, flood insurance is advisable and may be required through the NFIP. It's important to note that there is a 30-day waiting period from the date of purchase before your policy goes into effect, with some exceptions. It's also important to know that over 2000 homes flooded outside the identified high-risk zones after Hurricane Matthew.

Virginia flood maps have also recently changed, and your property could be at risk even if it's not in an identified flood zone. It's a good idea to contact your independent agent and discuss your risk annually.

Northern Neck Insurance Inland Flood Coverage

Remember, your standard homeowner’s policy does not cover flood damage, but we now offer an Inland Flood Coverage that can provide added protection to homeowners, renters, or small farm policy:

- when inland waters, such as streams or rivers, overflow and partially or completely

inundate normally dry land - unusual, rapid rain accumulation, runoff, or snowmelt that doesn’t drain away or soak

into the ground - when water carries mud and becomes a mudflow

Does car insurance cover flood damage?

The good news is that flooding is covered for your car if you have an NNINS auto insurance policy. It falls under “comprehensive coverage,” meaning protection for damage to your vehicle from things other than a crash. This includes natural disasters like flooding, vandalism, deer strikes, theft, and even fallen trees.

Here’s one safety reminder we can’t repeat enough. Driving through flooded roadways is not only bad for your car but also extremely dangerous. 76% of flood-related deaths are vehicle-related. So heed the warning when you see notifications on social media or TV urging you to avoid flooded roads! NOAA’s illustration does a nice job of showing this underestimated danger.

Stay Informed

We hope this helps you understand your risk for flood damage and how flood insurance is provided. Stay safe during flood events in your Virginia community; stay tuned to local alerts, follow advice from local officials, and avoid driving through flooded roadways. If you think you may need flood insurance for your home, contact your local NFIP-certified independent agent for assistance or the NFIP at (888) 379-9531.

Learn more about homeowners insurance in Virginia >

THE NORTHERN NECK INSURANCE INTEGRITY PROMISE — We pledge to provide straight talk and good counsel from our NNINS Virginia insurance experts through our blog. While we hope you find this to be a helpful source of information, it does not replace the guidance of a licensed insurance professional, nor does it modify the terms of your Northern Neck Insurance policy in any way. All insurance products are governed by the terms in the applicable insurance policy.