Sticker shock is the last thing you want after damage from a hurricane. To ensure you're financially prepared when the next big storm strikes, it's important to know if you have a hurricane deductible on your home insurance policy, especially if you live in coastal areas of Virginia.

Virginia Beach -Hurricane Isabel 2003- Photo: vims.edu

What is a hurricane deductible?

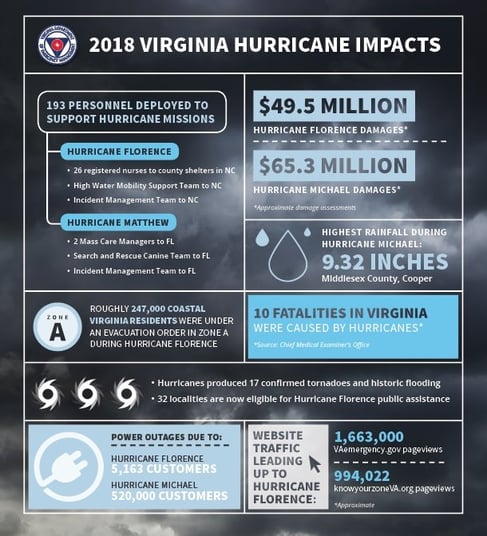

Since 2005, the increasing cost of Atlantic Basin hurricanes has prompted insurance companies in 19 states, including Virginia, to include hurricane deductibles, also known as "named storm deductibles." It was the extraordinary losses of Hurricane Andrew in 1992, followed by $41 billion in damages from Hurricane Katrina. Homeowners living in high-risk areas would need to assume some of that risk with these big storms to keep home insurance affordable for everyone. The financial impacts, as well as the danger of these storms, have continued to climb. Hurricane deductibles allow insurance carriers to provide coverage and manage the cost of premiums for their policyholders.

How do I know if I have a hurricane deductible?

If you have a named storm deductible, it would be listed on the declaration page of your homeowners policy and replaces the standard deductible on your policy when triggered. The named storm deductible is triggered when the National Weather Service (NWS) "names" a tropical storm or hurricane, and issues a hurricane watch or warning for any part of Virginia. This does not apply to a winter named storm.

What's the difference between a flat named storm deductible and a percentage named storm deductible?

Once that happens, instead of the standard deductible on a related home claim, your responsibility would be the flat named storm deductible or a percentage deductible of coverage A on your policy. A "flat named storm deductible" refers to a specific dollar amount that a homeowner pays out of pocket before their insurance coverage kicks in for damages caused by a named storm, like a hurricane or tropical storm. If you don't have a "named storm deductible" listed on your policy, you have the standard deductible, or what we sometimes call a non-named storm deductible, for a home claim during a hurricane or other named storm.

If your property's location requires a percentage deductible, you will have a 1%, 2%, or 5% deductible of your Home's value (coverage A). A lower percentage of deductible results in a higher annual premium. In comparison, a higher deductible lowers your yearly premium but will cost you more out-of-pocket in the event of a claim from a named storm.

For example, your Home's value is $300,000 (coverage A- Dwelling). In this case, your deductible on a weather-related claim for the named storm would be $3K for a 1% deductible with a higher premium. If you have a 2% deductible, you would pay $6K with a lower premium.

Does hurricane insurance cover flooding?

It's also important to remember that hurricanes can cause significant flooding. This type of flooding is not covered by standard homeowners insurance or a renters insurance policy. It's good to know that there are no named storm deductibles for a renters insurance or car insurance policy. If you have a renters policy, your personal belongings are protected from hurricane or storm damage, except for flooding, and your landlord's insurance is responsible for the structure. If you have comprehensive auto insurance coverage, your car is protected, even from flooding of your car during a hurricane.

Understanding your deductibles is another reason it's essential to build a relationship with your local independent agent. Coverages are often complex, and the details matter. The right agent will walk you through everything to be sure you understand your policy and coverage. They'll also help you ensure you are adequately covered for the risks to your home from a hurricane in your area. Use this time to make changes to your policy, like reviewing your deductibles. Changes to a named storm deductible on your home insurance policy can only be made before a hurricane is imminent or after it hits.

Financial planning ahead of time for a hurricane or named storm should factor into your family's hurricane plan. Visit FEMA's site for more information and assistance with financial preparation for a disaster or other emergency.

Learn more about homeowners insurance in Virginia >

NNINS Blog Home>

THE NORTHERN NECK INSURANCE INTEGRITY PROMISE — We pledge to provide straight talk and good counsel from our NNINS Virginia insurance experts through our blog. While we hope you find this to be a helpful source of information, it does not replace the guidance of a licensed insurance professional, nor does it modify the terms of your Northern Neck Insurance policy in any way. All insurance products are governed by the terms in the applicable insurance policy.