Does the Housing Market Impact Homeowners Insurance?

When will Virginia's housing market cool down? Who knows. We're seeing and hearing all kinds of things buyers are doing to get the home they want! If you have FOMO and are still in the market for a new home in VA, there are a few things you should know that may impact your home insurance. The last thing you want to do is have major regrets with such a major life investment.

Waiving home inspections

To compete with other prospective buyers and appeal to sellers with multiple offers, you may be tempted to agree to forego a home inspection. But there are real dangers to waiving this type of inspection. Virginia is a "buyer beware" or caveat emptor state. Under the Virginia Residential Property Disclosure Act, the seller must provide a disclosure that they do not make any representations about certain conditions related to the property. That means real-estate sellers are not required to fully disclose every issue with a home.

While a seller can not deliberately conceal defects, the buyer is required due diligence before purchasing a home. There may be problems the seller is not aware of, and it might be difficult to legally prove prior knowledge of defects. Once you sign your disclosure, the seller is protected from defects that are later discovered. Passing on your home inspection can have serious implications on the insurance for the home or insurance claims down the road. There are also smart ways to handle a home inspection in this fast pace and competitive housing market.

Insurance carriers may allow an appraisal to suffice for underwriting your new home's coverage, but it is entirely at their discretion. If the home is older, carriers will most likely require their own inspection before insuring it. This 4-point home insurance inspection is usually less comprehensive than a buyer's home inspection. It usually includes a visual inspection of the roof, plumbing systems, electrical systems, and heating and cooling systems. If the insurance company uncovers a problematic and costly issue after you've signed off on the home disclosure. If the home fails a 4-point home insurance inspection, you may be required to correct issues to qualify for insurance coverage.

Buying a home "as is"

If the home you found is a great price and for sale "as-is," you may be opening yourself to huge financial risk. Read our blog post on buying an as-is home in Virginia to learn everything you need to know.

Getting home insurance on older homes or a fixer-upper can be pricey, especially if the home's systems are outdated, replacement materials are unique or hard to find, or the home is not structurally sound. Replacement building costs are also much higher due to modern building codes and higher insurance rates. Home insurance carriers can also charge higher rates for outdated plumbing and electrical wiring, storm-sensitive roof or siding, and custom-sized windows and doors.

Risks in Virginia

It's important to consider the risks for new homes in certain areas of the commonwealth because they can impact home insurance rates. Being a coastal state with many waterways, two major fault lines, and the risk for Atlantic basin hurricanes means home insurance costs can vary significantly depending on location.

Flooding

Virginia is also a “buyer beware” state and has no flood risk exposure laws. It is up to you as a buyer to find out if you’re in a flood plain or at higher flood risk. Virginia flood zones are expanding. Buying a home with flood exposure not only means you may have to deal with a flooded home but that you'll also need to budget for flood insurance. Standard homeowners insurance does not include flood coverage.

You can visit Virginia's Flood Risk Information System to check on a home's flood exposure before you make an offer or sign your disclosure. This allows you to make the most informed and protected buying decisions, avoid costly surprises and devastating damage.

2011 Earthquake damage to home in Louisa, VA.

Earthquakes

While earthquakes don't frequently happen in Virginia, they do happen. Our home insurance covers damage from earthquakes, but most standard homeowners insurance policies do not. If you're buying a home in the commonwealth, it's wise to consult your local insurance agent to assess the area's earthquake risk.

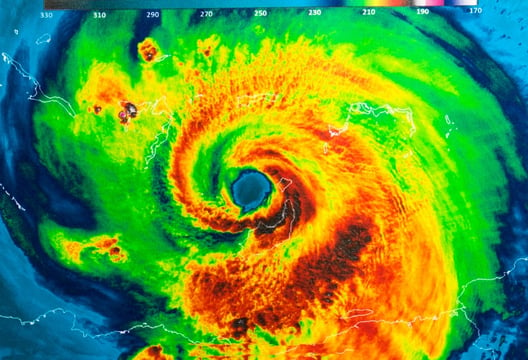

Hurricanes

As a coastal state, Virginia can experience significant hurricanes, even 100's of miles inland. Homes in higher-risk areas for damage, such as storm surge and high winds, may require a hurricane deductible, adding an expense to a claim. Flooding becomes a risk to homes with hurricanes as well.

Feeling informed and confident is the best way to search for your new home. Knowing the home insurance implications of the home you're considering is smart. Good luck with your search and let us know if we can serve your insurance needs!

Learn more about homeowners insurance in Virginia >

THE NORTHERN NECK INSURANCE INTEGRITY PROMISE — We pledge to provide straight talk and good counsel from our NNINS Virginia insurance experts through our blog. While we hope you find this to be a helpful source of information, it does not replace the guidance of a licensed insurance professional, nor does it modify the terms of your Northern Neck Insurance policy in any way. All insurance products are governed by the terms in the applicable insurance policy.