We pledge to provide straight talk from our NNINS Virginia insurance experts. Read the Northern Neck Insurance Integrity Promise.

Do you remember the 5.8 magnitude earthquake on August 23, 2011? It was centered about 38 miles northwest of Richmond in Louisa County. It was felt as far north as Quebec and south as Atlanta, Georgia. Damage was reported as far north as Brooklyn, New York, and Louisa County had an estimated $80.6 million in damages, with $63.8 million from damage to public school buildings and $14.7 million from damage to homes. Most standard homeowners’ policies do not include earthquake coverage. Unless you have specific earthquake coverage, you are responsible for all costs to repair or rebuild your home and replace personal property.

Grocery store in Mineral, VA, 2011

Does Virginia have earthquakes?

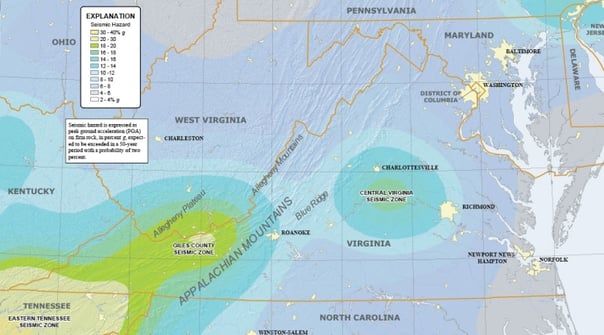

Surprisingly, the Commonwealth has averaged one earthquake per month since 1977. Thankfully, the majority are too small to be felt or cause damage. Most seismic activity in Virginia is centered in two zones: one stretching from the Richmond area to Charlottesville and another in the New River Valley in Giles County. According to the USGS, residents in Southwestern Virginia should also be aware that the Eastern Tennessee seismic zone is one of the most active earthquake areas in the Southeast.

Map: Department of Geology and Mineral Resources, DM

Factors to help you consider your earthquake risk

The USGS (United States Geological Survey) suggests the following criteria to assess earthquake risk with your local insurance agent:

- proximity to active earthquake faults

- frequency of earthquakes in your region

- time since the last earthquake

- building construction (type of building and foundation)

- architectural layout

- materials used

- quality of workmanship

- the extent to which earthquake resistance was considered by the builder/architect

- local site conditions (type and condition of the soil)

- slope of the land

- fill material

- geologic structure of the earth beneath

- annual rainfall

- value of the building and its contents

- cost of the insurance and restrictions on coverage (i.e. the deductible).

What does earthquake insurance cover?

Virginia's 2011 earthquake caused pricey home damage: destroyed chimneys, cracked foundations, crumbled walls, and broken water lines that led to minor flooding. Homes with foundation damage can have repairs totaling $5,000-$10,000 and there are often other repairs needed such as damaged plumbing, gas lines, and cosmetic issues. While this type of damage is typically not included with standard home insurance policies for most big insurance companies, earthquake insurance is included with NNINS's broadest home coverage.

How much does earthquake insurance cost in Virginia?

Although earthquake insurance is not included in most standard home insurance policies, you can purchase it. The annual cost is usually between $100 and $300 annually. Pay close attention to the deductible and make sure it's worthwhile. You can also add our Homeowners Enhancement Endorsement to a standard home insurance policy for less than $100 annually which includes earthquake coverage. If you live in an area of Virginia that may be more prone to earthquakes or don't know your risk, speak with a local agent to see if this coverage is right for you!

Does renters insurance cover earthquakes in Virginia?

Similar to standard home insurance policies in Virginia, standard renters policies do not cover damage to your personal property from earthquakes. You can always purchase additional earthquake coverage to protect your stuff. There's no need to worry about any out-of-pocket expense for structural damage. Your landlord is responsible for earthquake insurance for the home or apartment.

How can I prepare for an earthquake?

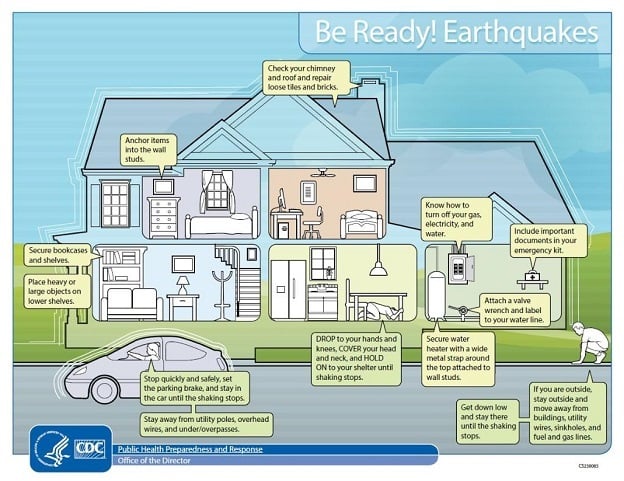

If you and your family experience an earthquake in your Virginia home, your safety is the most important thing. The CDC graphic illustrates the things you can do to make it safer before an earthquake. It also shows what to do to protect your family during an earthquake. Here's a great video from Fairfax County Government:

Each October, FEMA has The Great Southeast Shakeout and Virginians are invited to join the region to practice their earthquakes drills. You can also find out more about earthquakes in Virginia by visiting Virginia's Geology and Mineral Resource. It's always best to have a plan!

Resources:

https://www.youtube.com/@fairfaxcounty

https://www.cdc.gov/earthquakes/safety/index.html

https://www.energy.virginia.gov/geology/GeologyMineralResources.shtml

Learn more about homeowners insurance in Virginia >

THE NORTHERN NECK INSURANCE INTEGRITY PROMISE — We pledge to provide straight talk and good counsel from our NNINS Virginia insurance experts through our blog. While we hope you find this to be a helpful source of information, it does not replace the guidance of a licensed insurance professional, nor does it modify the terms of your Northern Neck Insurance policy in any way. All insurance products are governed by the terms in the applicable insurance policy.