Getting to know your new home

There are a few "adulting" milestones that should come with a serious manual. Starting your first real job, getting married, and having a baby to name a few. What about buying your first home? Signing your name on a tall stack of papers and getting those keys can be simultaneously exciting and terrifying. Your new home comes with a daunting number of unique systems. Your home inspection can help, but keeping those systems running well is key to protecting your investment. And they can really save you money in the long run!

Lifecycles of home major home systems

Let's name and navigate those basic systems and estimate how long they will last. Lifespans are dependent on the quality of the system, amount of use, and maintenance. If you're diligent about taking care of these home systems, they can really last, save you money, and help you avoid costly home insurance claims.

Home insurance coverage for home systems

We'll also generally explain how home insurance can provide coverage when things go awry. Keep in mind every home insurance is different and every claim is different. That can make homeowners insurance feel complicated and we want to help with straight answers. Home insurance covers your home and property from damage from very specific things and also excludes specific things or requires you to purchase that coverage separately.

Essential things you should do about your home

It's important to remember that home insurance works best when you take care of your home and do everything possible to prevent damage. Home insurance does not cover damage due to neglected maintenance. The best thing to do is to review your insurance coverage annually with an insurance expert in your area to fully understand your coverage and to make changes as your protection needs change.

1. Locate your water shutoff valve

Average water shutoff valve lifespan: 10-20 years

This is the perfect place to start and so important to know! To do this, you’ll need to locate the shut-off valve connected to the main water line entering your home. In our article on how to shut off your main water valve, we also cover water supplies for toilets, sinks, and appliances.

Home insurance can cover flooding mishaps inside the home from failing appliances and burst pipes, which is treated differently than flooding from weather events. There are also added home insurance endorsements you can purchase like water backup coverage for sewers and drains.

2. Understand your electrical panel

Average electrical panel lifespan: 30-50 years

The electrical panel is essentially the brain of your home’s electrical system. It is the control center of your home’s power and one of the most crucial systems in your home. Also known as the circuit breaker box, it protects a home’s wiring and prevents electrical shock or fire.

if an electrical appliance suddenly has no power, check another outlet. If another outlet works (try several), you may have a tripped circuit. A tripped breaker will send you looking for your electrical panel. You should know how to turn it off in an emergency and how to reset a tripped circuit. Individual circuit breakers should be labeled by the area they power in your house. If not, you can identify and label them yourself by turning each breaker off and on. It helps to have a partner for this project.

Home insurance can cover the replacement of your electrical panel if the malfunction was caused by perils listed in your homeowners insurance policy such as fire, windstorms, theft, and vandalism. It does not cover wear and tear and maintenance issues.

3. Inspect your gutter system

Average gutter system lifespan: Galvanized steel and aluminum- 20 years/ Copper- 50 years

Speaking of water and flooding, your home's gutter system is a combination of gutter lines, elbows, joints, downspouts, and extenders that move water away from your home's foundation. Justin, our home protection expert, says that gutters are the #1 most neglected and problematic issue in home claims next to home roof problems. Costly ones too. We’ve had claims run upwards of $10,000- $12,000!

Speaking of water and flooding, your home's gutter system is a combination of gutter lines, elbows, joints, downspouts, and extenders that move water away from your home's foundation. Justin, our home protection expert, says that gutters are the #1 most neglected and problematic issue in home claims next to home roof problems. Costly ones too. We’ve had claims run upwards of $10,000- $12,000!

Home insurance can cover damage to exterior parts of your home, like gutters, from listed perils in your home insurance policy such as fire, windstorms, theft, and vandalism, but not maintenance-related issues. Get familiar with your home's gutter system and keep it clean!

4. Test your sump pump

Average sump pump lifespan: 10 years

Part of your home's drainage system may include a sump pump if you have a basement. If the groundwater around your foundation reaches a certain level that could result in basement flooding, a sump pump will pump that water up and away from your foundation. Your sump pump needs to be tested regularly and should have a backup battery in case you lose power. A sump pump without a covering will develop clogs from accumulating dirt and debris.

Part of your home's drainage system may include a sump pump if you have a basement. If the groundwater around your foundation reaches a certain level that could result in basement flooding, a sump pump will pump that water up and away from your foundation. Your sump pump needs to be tested regularly and should have a backup battery in case you lose power. A sump pump without a covering will develop clogs from accumulating dirt and debris.

If you don't have a sump pump and your basement floods, take immediate steps to prevent costly damage. Standard home insurance won't cover things like flooding from a river rising nearby or rain leaking in through the foundation or automatically include sump pump overflow coverage.

Home insurance endorsements can cover flood damage from sump pump failures depending on the cause and what add-on coverage you have in place. Check with your local agent to see if a home insurance endorsement or rider for equipment breakdown or water backup coverage makes sense for you.

5. Get to know your well, sewer, and septic systems

Well

Average well lifespan: 30-50 years

Make sure you know the location of your well if your home isn’t connected to a city water supply. Knowing the location and general design of your well system can help with repairs if part of your system begins to fail. Your well may be located indoors in a crawlspace or basement. If you cannot locate it inside, look for signs of a well cap, casing, or indentation in your yard.

Sewer lines

Average sewer lines lifespan: Clay 50-60 years/ PCV 50-100 years

Issues such as wastewater backups and problems with drainage are no fun! Prevention can start with awareness of your sewer line and the early symptoms of a problem. Many people don’t know this but if you are a homeowner on city sewer service, you are responsible for the portion of your sewer line that leads from your house to the main sewer line under the street. If you have a blockage, a clogged sewer line, or mud in your sewer pipe, it’s up to you to find a plumber who can clear it.

Avoid planting trees with invasive root systems around your home. They can infiltrate sewer lines over time, impede flow, and cause backups. Common signs that there is a problem are:

- Small frequent drain backups

- Strange symptoms when using your plumbing fixtures, like a flushed toilet causing a tub or shower to backup

- Smelly puddles of mud, sludge, or sewage in your yard

- Slow flushing toilets

Home insurance endorsements for service line coverage added to your home insurance policy can cover sewer line failures. Check with your local agent to see if Service Line Coverage makes sense for your home.

Septic System

Average septic system lifespan: 20-30 years

For septic systems, you’ll also want to know where your tank access points are located, as well as any inspection ports. The Virginia Department of Health (VDH) recommends the average household septic system be inspected at least every three years by a licensed septic service professional. When you call a septic service provider, they will inspect for leaks and examine the scum and sludge layers in your septic tank to:

- prevent too much sludge from accumulating in the tank, which prevents settling before sewage flows to the drain field

- maximize the life of the septic tank

- prevent the discovery of a septic system failure by the experience of untreated sewage backing up into the house

VHD provides a septic system service provider finder tool for those properly licensed in accordance with Virginia state law.

Homeowners insurance can cover your well and septic tank if it's damaged by a sudden and unexpected event listed as a covered peril, like fire, windstorms, theft, vandalism, ice, or snow, but not for everyday wear and tear. If your well or septic fail because you neglected to maintain or fix it, your insurer will hold you liable for the failure and, therefore, will not pay to repair or replace it.

6. Inspect your roof and attic

Average roof lifespan: Asphalt 10-20 years/ Clay 50 years/ Metal 70 years/ Slate 100+ years/ Wood 20-30 years/ Concrete 50 years

Your roof depends on those gutters, but also needs to be maintained to protect your home from the top down. Like other parts of your home's exterior, your roof needs maintenance and regular inspections and has a life span. Severe weather like wind and hail can cause damage to your roof that is not visible from the ground. There will come a point where your roof needs to be replaced. It's definitely a big-ticket item you should be financially planning for.

Your roof depends on those gutters, but also needs to be maintained to protect your home from the top down. Like other parts of your home's exterior, your roof needs maintenance and regular inspections and has a life span. Severe weather like wind and hail can cause damage to your roof that is not visible from the ground. There will come a point where your roof needs to be replaced. It's definitely a big-ticket item you should be financially planning for.

Your attic also needs regular inspections that are usually done at the same time as your roof. Crawlspaces should also be checked. Critters love to make your home theirs, especially while they are raising young and can cause costly damage.

Home insurance can cover damage to your roof and attic from specific perils listed in your policy like fire, windstorms, and hail, but does not cover normal wear and tear, damage from animals, or other maintenance issues.

7. Find your gas shutoff valve

Average gas shutoff valve lifespan: 10-15 years

Your home may be configured to use natural gas to fuel appliances, such as your furnace, hot water heater, fireplace, oven, dryer, and more. In case of a gas leak, you'll need to know the location of your shutoff valve. A sign of a gas leak most notably is the smell of rotten eggs, but gas leaks outside may be less obvious. If you suspect a gas leak, turn off your main gas valve, go outside your home, and call 911 and your gas utility company right away. In most cases, your main gas shut-off valve will be located outside the home near the gas meter and may require a wrench.

A licensed professional plumber or heating technician can service your gas shutoff valve and you are required to maintain and repair it. Home insurance can cover damage to your valve from specific perils listed in your policy like vandalism, fire, windstorms, and hail.

8. Check on your gas, water, and electric meters

Average utility meter lifespan: 15-20 years

After you begin receiving your first utility bills, you may wonder how much fuel, energy, and water you're using and how it affects your bills. To measure your home’s gas, electric, and water use, each utility service will have its own meter. These meters are located outside, usually on the side of your home. Be sure to keep the area around them clear of vegetation and easily accessible for utility service workers.

Utility meters are maintained by the utility company and Virginia law requires timely maintenance of a broken meter if they receive a written complaint from the homeowner. You are also not required to pay your bill and your service can not be terminated until the meter has been serviced and works correctly.

9. Know your property lines

Becoming aware of the boundaries of your property is essential when it comes to exterior projects like landscaping and fence installation. It can also help you be a better neighbor by telling you how far over you should mow your lawn and how much sidewalk you’re obligated to shovel.

You can usually determine your property lines by locating buried property markers at the four corners of your lot. If you can not locate them, you may need to hire a surveyor. Also, your deed contains measurements, descriptions, plat maps, or a combination of the three that explain how much property you own. Call or visit your local Virginia courthouse to see if a plat map can help you find your property lines.

10. Check out your HVAC system

Average HVAC system lifespan: 10-20 years

You'll want to investigate your HVAC systems and locate user manuals if possible. Some homes have more than one HVAC unit. It's important to know if your furnace runs on gas/electric or both if you have added systems with a humidifier, and what type and size of filters it requires. Most furnaces have filters within the interior unit as well as filters on returns throughout your house and may be different sizes. Change those filters every 30 to 90 days depending on pets, allergies, and the type of filters you buy to improve the air quality and lifespan of your HVAC system. Annual maintenance is also a good idea, especially for older units.

You'll want to investigate your HVAC systems and locate user manuals if possible. Some homes have more than one HVAC unit. It's important to know if your furnace runs on gas/electric or both if you have added systems with a humidifier, and what type and size of filters it requires. Most furnaces have filters within the interior unit as well as filters on returns throughout your house and may be different sizes. Change those filters every 30 to 90 days depending on pets, allergies, and the type of filters you buy to improve the air quality and lifespan of your HVAC system. Annual maintenance is also a good idea, especially for older units.

Home insurance can cover damage to your valve of covered equipment like vandalism, fire, lightning, and hail but does not cover normal wear and tear, damage from animals, or other maintenance issues. The added coverage from an Equipment Breakdown Endorsement can cover damage from sudden and accidental mechanical or electrical breakdowns.

11. Clean and replace appliances, filters, and vents

Average appliance lifespan: 8-15 years

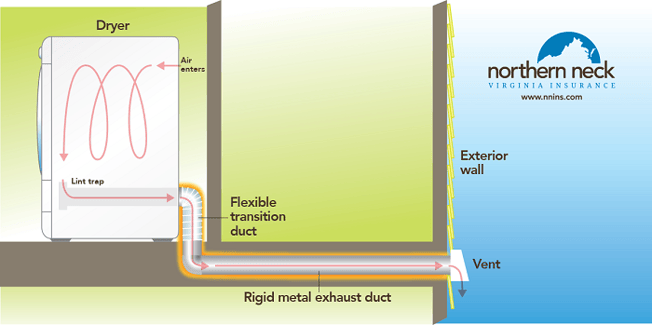

Try to put your hands on appliance manuals for the appliances that came with your new home and familiarize yourself with their settings and operations. Many appliances have filters and vents that need regular cleaning. Dishwashers have a drain trap on the inside bottom of the appliance. Your dryer has a lint trap that needs constant cleaning and another exterior vent that needs regular attention. Even your refrigerator has a vent on the back that needs occasional cleaning and may have filters for water that need to be replaced in a recommended cadence.

12. Test your smoke and carbon monoxide alarms

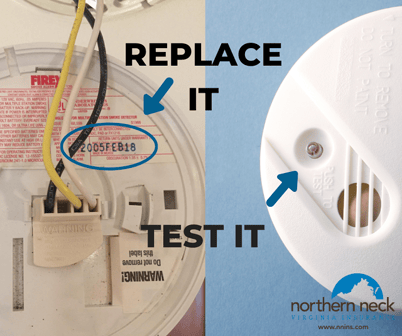

Average detector lifespan: Smoke detector 10 years/ CO alarm 7 years

Some models of smoke detectors are designed to run on batteries while other "hard-wired" smoke alarms use household current as their primary power source. Some hard-wired smoke alarms use batteries as a backup source of electricity during power outages. There are also models of smoke alarms that come with 10-year lithium batteries and others plug right into the wall while others also include carbon monoxide detection. Confusing, right?! Whatever smoke detection system your home has, be sure to know what type you have and the maintenance it needs.

Carbon monoxide detectors notify you of odorless, colorless gas created when fuels (such as gasoline, wood, coal, natural gas, propane, oil, and methane) burn incompletely. In the home, heating and cooking equipment that burn fuel are potential sources of carbon monoxide. Vehicles, fireplaces, grills, or generators running in an attached garage can also produce dangerous levels of carbon monoxide.

Ensure one smoke alarm and one carbon monoxide detector are installed on every level of your home, including your basement. Test smoke detectors monthly by pushing the "test" button or using other procedures recommended by the manufacturer. Install new batteries annually and whenever the smoke alarm makes a "chirping" sound. The chirping sound indicates that the battery in the smoke detector is nearly dead and needs to be replaced immediately. Check the date on the back of your smoke detector and replace them when expired.

13. Maintain your fireplace

Average fireplace lifespan: Brick masonry 100+ years/ Factory built 20-30 years/ Gas 15-25 years/ Electric 10-20 years

If your home has a gas or wood-burning fireplace, explore its manuals and do regular maintenance. Learn how to operate the damper. The Chimney Safety Institute of America also recommends that your chimney is inspected once a year to protect against risks associated with fire and carbon monoxide. If you have a gas fireplace, learn how to turn off the gas for warm weather months, then turn on the gas and light the pilot for use during the winter season.

If your home has a gas or wood-burning fireplace, explore its manuals and do regular maintenance. Learn how to operate the damper. The Chimney Safety Institute of America also recommends that your chimney is inspected once a year to protect against risks associated with fire and carbon monoxide. If you have a gas fireplace, learn how to turn off the gas for warm weather months, then turn on the gas and light the pilot for use during the winter season.

14. Consider a home security system

Average security system lifespan: 12-20 years

If you bought a home with an existing security system, you may need to set up a new contract for monitoring with a security company. Some alarm system companies program their systems to make them incompatible with other companies or equipment.

Even if your new home doesn't have a security system, there are plenty of affordable actions as a new homeowner you can take to improve your new home’s security, either by dissuading burglars or making it harder for them to gain access. To start, it's wise to change your new home's door locks. There's no telling how many copies of house keys could be floating around with the former owner's family, friends, pet sitters, and neighbors.

We're local home insurance and ready to help

We hope this guide helps you navigate homeownership with confidence. We provide local home insurance for Virginians and are here for you. Let us know how we can serve you! Now that you're familiar with your home's systems, connect with your local independent agent to explore those extra coverages for your home.

THE NORTHERN NECK INSURANCE INTEGRITY PROMISE — We pledge to provide straight talk and good counsel from our NNINS Virginia insurance experts through our blog. While we hope you find this to be a helpful source of information, it does not replace the guidance of a licensed insurance professional, nor does it modify the terms of your Northern Neck Insurance policy in any way. All insurance products are governed by the terms in the applicable insurance policy.