Peak hurricane season is here, Virginia!

From August 15th to November 30th, we see some of the most active weather in the tropics. September 10th statistically marks the start of the height of Atlantic hurricane season. NOAA's forecast calls for above-normal tropical activity this hurricane season. NOAA expects 4 to 7 major hurricanes (category 3, 4, or 5) with winds of 111 mph or higher. These predictions are influenced by La Nina conditions in the Pacific, near-record warm ocean temperatures in the Atlantic Ocean, lower Atlantic trade winds, and less wind shear. Hurricane categories can greatly impact Virginia homes and it's important to have a plan to protect your family and property.

Have a plan

Here at NNINS, we never underestimate any hurricane's possible impact on Virginians, and for a good reason. We know from experience it only takes one of these tropical cyclones to devastate property and result in costly damage and flooding. Your family should prepare by having a good hurricane plan. We also have a Hurricane Resource Guide for Virginians with trusted resources.

3 Ways to prepare your home for a hurricane this fall

We can tell you how best to shield your home from the top risks to your home for hurricane damage. The answers to the following three questions could save you a ton of heartache from whatever is in store for the commonwealth this fall.

1. Will your roof protect everything under it?

Your #1 preemptive weapon in your home’s arsenal is its roof. It’s also the most susceptible to costly storm damage. We can’t emphasize enough how important it is that you maintain yours with an annual professional inspection. Virginia has already experienced early tropical activity, so get a professional check if you haven't this year, anytime you suspect damage may have occurred, and don't delay replacing your roof when needed.

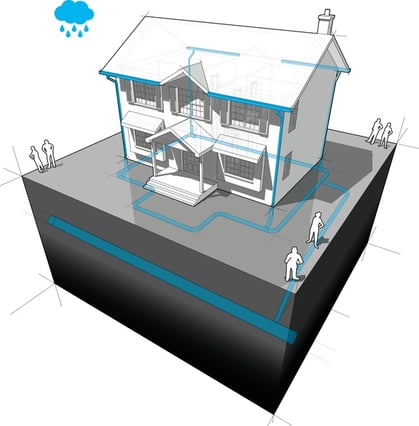

2. Are your gutters and downspouts clean and clear?

Your gutters and downspouts are second in line for protecting your home from the rainy deluge that hurricanes often bring. They need to drive all that rainwater down and away from your foundation. They can’t do it if they’re full of debris from the previous seasons. Annual maintenance is crucial to waterproofing your home during extreme and sustained rainfall.

3. Do you have the right home insurance coverage?

This is probably the most important question you should answer before the next big storm. When was the last time you updated your insurance policy? It's critical to speak to your independent agent to make sure you are sufficiently covered for hurricane season, especially if you’ve recently done anything to your home that added value. Your local agent is the insurance checkup expert you need to ensure you have enough homeowner insurance to repair or even replace your home.

Remember to prepare your car or boat. Also, remember that standard homeowners insurance doesn’t cover flooding. Whether you’re a homeowner or renter, you’ll need a separate policy for flood damage. It’s available through the agent locator at www.floodsmart.gov. Act now; flood insurance requires a 30-day waiting period.

Let’s hope peak season doesn't impact Virginians this year, but always hope for the best and prepare for the worst. Start by getting the right answer to these three important questions. Let us know if we can be of service to you or provide a homeowners insurance quote with an independent agent in your Virginia community. We are a Virginia-only insurer by choice and have lived through hurricanes since 1896! We specialize in preserving the things Virginians value most and would be honored to protect yours.

Learn more about homeowners insurance in Virginia >

THE NORTHERN NECK INSURANCE INTEGRITY PROMISE — We pledge to provide straight talk and good counsel from our NNINS Virginia insurance experts through our blog. While we hope you find this to be a helpful source of information, it does not replace the guidance of a licensed insurance professional, nor does it modify the terms of your Northern Neck Insurance policy in any way. All insurance products are governed by the terms in the applicable insurance policy.