We pledge to provide straight talk from our NNINS Virginia insurance experts. Read the Northern Neck Insurance INTEGRITY PROMISE.

What is Inland Flood Coverage?

Inland Flood Coverage is added insurance protection with a standard home insurance policy for homeowners and renters who may not be in a high-risk flood zone but who could experience flash floods or other unexpected sudden flooding. Inland Flood Insurance does not satisfy the flood insurance requirements of your policyholder’s lending institution for your home mortgage or loan for those living in high-risk flood areas. Since standard homeowners insurance does not cover home flood damage, it’s a good idea to consider purchasing flood protection even if you’re not required to have flood insurance. It's also quite affordable.

Designed specifically for residents in low-to-moderate risk areas, this insurance covers the most common exposures Virginians face from inland floods, including damage to personal property, basement exposures, and appliances when:

- inland waters, such as streams or rivers, overflow and partially or completely

inundate normally dry land - unusual, rapid rain accumulation, runoff, or snowmelt that doesn’t drain away or soak

into the ground - water carries mud and becomes a mudflow, not a mudslide.

What's Covered by Inland Flood Insurance?

Inland Flood Insurance can include coverage for damage for:

- your residence and certain other structures (shed, pool house)

- basement flooding, any sunken room, a sunken portion of a room, garage, or

crawl space, having any side of its floor below ground level. - basement personal property (The NFIP excludes coverage for basement personal property.)

- loss of use (pays for additional living expenses you incur if your home is not suitable to live in due to a covered loss)

- the cost to move the policyholder's property to safety (first 30 days)

- debris removal

What Is Not Covered by Inland Flood Coverage?

Inland Flood Insurance does not cover damage to your:

- personal property not inside your home, like patio furniture or a grill

- deck or fence

- lawn, trees, or landscaping

- earth movement or seepage from the water table rising with no flooding near your house

- sump pump discharge or overflow, or backup of sewers or drains, unless caused by the covered flooding event

What Causes Inland Flooding in Virginia?

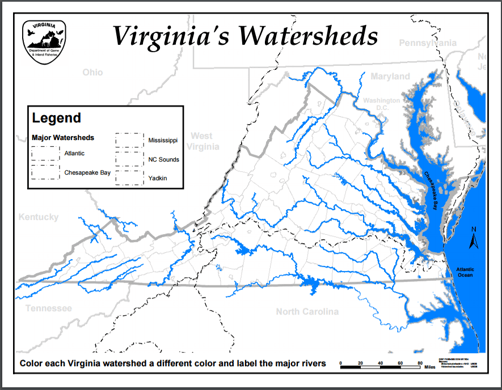

Southwest Virginia has faced five major floods in five years, causing severe damage to community lifelines. Flooding is a statewide hazard in Virginia, from hurricane storm surges, mountain runoff, excessive rainfall, and tidal water. Virginia has extensive tidal water systems that extend inland as far as Richmond and Fredericksburg, and even Northern Virginia, in Arlington and Alexandria. Even tiny streams and low-lying ground that seem harmless in dry weather can quickly flood from heavy sustained rainfall.

Inland flooding can also be caused by snow and overflows of other water systems. The most common exposures to flooding include living near bodies of water, especially low-lying areas, behind a levee, or downstream from a dam.

When it's Wise to Invest in Protection

While flooding is the most common and costly natural disaster, only approximately 3% of Virginians have flood insurance. Your property's propensity to flood activity can be explored through the Virginia Department of Conservation and Recreation's Flood Risk Information System. It's important to know that flooding can occur on any property, not just within high or moderate flood-risk areas.

It is estimated that 1 inch of water in a home can cause upwards of $25,000 in damages. If you do not have savings in reserve for this type of repair and restoration, Inland Flood Coverage might be a wise investment. The Inland Flood Endorsement is ideal to add to standard Home Insurance for properties with a basement (finished and unfinished) or crawlspace foundation.

Sources:

THE NORTHERN NECK INSURANCE INTEGRITY PROMISE — We pledge to provide straight talk and good counsel from our NNINS Virginia insurance experts through our blog. While we hope you find this to be a helpful source of information, it does not replace the guidance of a licensed insurance professional, nor does it modify the terms of your Northern Neck Insurance policy in any way. All insurance products are governed by the terms in the applicable insurance policy.