Think of umbrella insurance as an extension of liability protection beyond the coverage you get from your home, car, and even renters insurance policies. Think of it as a supplemental policy. Umbrella insurance also can protect you financially in situations outside of the typical coverage you get from your home and car insurance. The policy does not cover your injuries or property damage the way your car and homeowners insurance does but extends the liability insurance of those policies. Let's break it down and find out if it's worth it for Virginians.

How Does Umbrella Insurance Work?

There are a variety of scenarios where umbrella insurance can protect you from facing a serious financial loss as a result of the claim. Unfortunately, lawsuits can happen at any time. Some lawsuits can be covered by standard home insurance and car insurance policies, but the awarded amount often exceeds the limits of those policies, and there are certainly some incidents that they will not cover.

Liability coverage extends to more situations and has higher limits than your primary personal insurance policies. Some scenarios include:

- Your dog bites a neighbor's child's face causing disfiguring damage.

- You incur legal fees from a slanderous message on social media that causes someone psychological harm or mental anguish.

- Your guest to your home is badly injured and disabled from a slip and fall on ice.

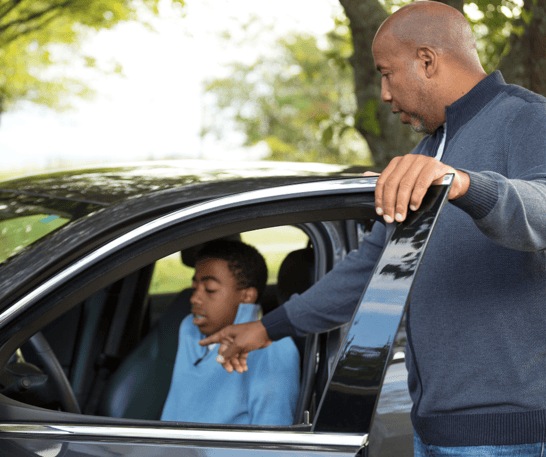

- Your teenage son runs a red light and causes a crash with multiple cars and badly injures multiple people.

Is Umbrella Insurance Worth it?

Consider Your Lifestyle

Sometimes location may have an impact on whether or not umbrella insurance is worth it. For example, if you live in Virginia and travel frequently on certain high-risk roads, umbrella insurance could provide an added level of protection. One of the most common benefits of umbrella coverage is liability protection from damages caused by an auto accident when you are at fault.

It's more often your personal circumstances that will or will not indicate the value of adding this extended coverage. This personal liability coverage might also be worth it if you:

- have a teen driver in your home

- have a swimming pool or a trampoline

- have other play equipment

- own a dog

Consider Your Assets

The best way to decide if umbrella insurance is worthwhile for you is to figure out if your asset value exceeds the limits of either your auto or homeowner’s insurance. Umbrella insurance tends to protect those with high net worth who want to protect future earnings.

To determine the value of your assets, add up your home's equity, other owned real estate, bank accounts, brokerage and retirement accounts, and other savings accounts such as a child's college fund. Then check your home and auto insurance limits and see if the total asset value is greater than either of those limits. If one of them is, consult with a local insurance agent to inquire about umbrella insurance.

How Much Umbrella Insurance Do I Need?

If you determine umbrella insurance is the right choice for your situation, again consider the total value of your assets minus the limits of your home and car insurance policy to decide how much coverage you want. We can't emphasize enough how valuable a local insurance agent can be in this process. While umbrella insurance can be affordable, you'll need to put thought into the right amount.

Here at Northern Neck Insurance, you can add personal liability insurance to your home, car, or renters insurance.

- Our basic umbrella insurance has a limit of $1,000,000.

- Increased limits up to a total policy limit of $5,000,000 may be available.

- Policies with youthful drivers are eligible for policy limits of $1,000,000 maximum.

What Does Umbrella Insurance Not Cover?

Personal liability insurance is not for small business situations such as using your car for professional services, someone who owns many large rental property units, and certain types of libel or slander. There are also specific exclusions as with most insurance policies. One example of an exclusion is intentional bodily injury or property damage.

There are many coverage nuances from one insurance carrier to another, so speaking with your local independent agent is key to the shopping process. They can consider your specific situations and make the best recommendations for you.

Learn more about umbrella insurance in Virginia >