Home insurance was created to protect you financially from all kinds of potential damage and liability. A mutual home insurance company, like NNINS, has the responsibility to ensure that the premium it collects is balanced against the costs of covering potential future claims by our members. This process sometimes requires our underwriting team to perform an exterior home inspection of insured homes, which may include taking pictures of your home. Your participation in the process can help ensure you have adequate coverage and minimize your liability and risk. Let’s take a look at the types of risks we see and why those risks may indicate the need for pictures of your home or property.

Common insurance hazards

Pictures can provide more information and confirm a property's expected condition or hazard. A claim for new property damage is the most common reason an insurance provider will send an adjuster to your home to take pictures. These pictures support his or her findings and provide important information for an estimate of repairs. A new policy or purchasing a new home can also indicate the need for an inspection and pictures, especially if your carrier has concerns about existing hazards. Sometimes there simply aren’t any current pictures available of your home or property.

Here are common home insurance hazards that may indicate the need for pictures:

- Trees on your property with long, heavy branches hanging over your roof or close to your home.

- Your home deck may have missing railings, rotting wood, or other safety concerns.

- Your home has maintenance issues such as neglected gutters.

- A newly added pool, trampoline, or other play equipment

- Weather-related water damage from heavy rain or snow or non-weather related-water damage from leaking or burst pipes and malfunctioning appliances.

- An aging roof, stucco damage, missing siding, or other signs of visible wear and tear or decay.

- Your home is very old or has unique construction elements or recently had a major renovation.

Avoiding claims

Your home insurance claims history can also trigger the need for pictures of your home, especially if you have experienced multiple claims in a short period of time. That also may include an interior inspection to identify pre-existing issues.

Although you can’t completely prevent home claims from things like wind and hail, you can take steps to prevent major damage, like removing dead trees and branches and storing patio furniture and other things on your property that could be blown into your house. Lock and reinforce your doors, windows, and garage, and keep your roof in good shape. Make sure your property is well-lit at night, especially when you travel. A home security system may be a good idea if you live in a high-crime area and also may get you a home insurance discount.

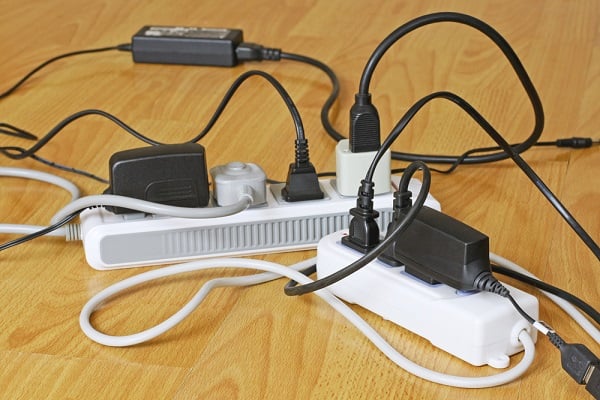

To prevent home fire claims, install smoke detectors and use flameless candles whenever possible. Keep your kitchen clear of clutter, especially around your stove, toaster oven, and microwave. Have your chimney cleaned and inspected at least once a year, and dispose of ashes outdoors in a fireproof container. Get your electrical wiring inspected for flaws, especially if you live in an older home. Avoid using frayed or exposed wires and don’t overload power outlets.

Avoiding liability claims and lawsuits

Home insurance liability claims most often come from accidents, slips and falls, and dog bites. To prevent a slip and fall claim, keep your sidewalk, driveway, porches, patios, and stairwells free of tripping hazards, rotting wood, exposed nails, and ice. Ensure your insurance carrier knows you have a new pool, trampoline, or play equipment, and always monitor and follow all safety protocols. Keep your pet leashed outside and watch them closely around small children to prevent dog bites. Also, be sure your home insurance carrier covers your dog’s breed.

How to take pictures for an insurance company

If you are asked to provide pictures to your insurance carrier, be sure to include all angles and aspects of your damaged property and include complete corners of your house or interior room. Keep the sun behind you so that it shines onto the subject of your photo, and use a table or wall for extra stability. Zoom in on any property damage. This is a great opportunity to complete a home inventory as well!

In the event of a home insurance claim, we never want anyone to attempt to take photographs if there’s any risk to your health or safety. Call necessary emergency responders if needed, report your claim, and leave the rest to your adjuster.

Learn more about homeowners insurance in Virginia

THE NORTHERN NECK INSURANCE INTEGRITY PROMISE — We pledge to provide straight talk and good counsel from our NNINS Virginia insurance experts through our blog. While we hope you find this to be a helpful source of information, it does not replace the guidance of a licensed insurance professional, nor does it modify the terms of your Northern Neck Insurance policy in any way. All insurance products are governed by the terms in the applicable insurance policy.