Virginia’s Uninsured Motorist Fee

Today, Virginia is one of just two states that do not require drivers to purchase car insurance. Drivers can pay a yearly $500 uninsured motor vehicle fee in lieu of an auto policy through an insurance carrier. This UMV fee is paid each time you renew your vehicle registration and allows drivers to operate an uninsured vehicle at their own risk. The $500 fee payment does not provide the motorist with insurance coverage, and the uninsured motorist remains personally liable if involved in an accident. Revenue from the fees goes into Virginia’s Uninsured Motorist Fund, which is intended to help insurance companies cover uninsured motorist claims. As of July 1st, 2024, this will no longer be an option for drivers.

What is Virginia's new car insurance law?

The state voted to discontinue its UMV fee and drivers will no longer be able to register an uninsured vehicle by Virginia law. Starting July 1st of 2024, all drivers operating their vehicles on public roads in the commonwealth must carry at least the state-mandated minimum amount of liability insurance.

What are the current minimum car insurance requirements in Virginia?

Drivers who previously registered uninsured motor vehicles must buy a liability policy with state minimum requirements from an insurance company under Virginia's new car insurance law starting July 1st. Current Minimum Insurance Requirements in Virginia are:

- $30,000 bodily injury liability per person

- $60,000 bodily injury liability per accident

- $20,000 property damage liability per accident

What will be the changes to the minimum car insurance requirements in 2025?

Virginia’s laws regarding minimum coverage have also been updated, and they are scheduled to increase on January 1, 2025.

The new Virginia insurance requirements will be:

- $50,000 bodily injury liability per person

- $100,000 bodily injury liability per accident

- $25,000 property damage liability per accident

How will Virginia's 2024 car insurance law affect me?

If you currently have car insurance in Virginia, this law will not affect you. If you do not have car insurance, you can technically drive without insurance if you pay the UMV fee upon registration until July 1st, 2024. However, you may want to consider purchasing a policy instead of waiting for the new law to take effect.

Accidents without car insurance in Virginia

Auto insurance coverage is critical if you get into a car crash. Virginia is an at-fault insurance state. This means that the driver who collided with you is responsible for any damage caused by the crash. If the at-fault driver has auto insurance, you can be compensated by their insurer.

Your car insurance policy's Uninsured/Underinsured Motorist Coverage will compensate you for the damage you suffered from an at-fault uninsured driver. This coverage protects you directly if you are injured by a driver whose liability limits are not high enough to cover your damages and not as high as your policy's UM/UIM liability limits. Uninsured drivers at fault can be sued for damages. Many car accidents result in medical expenses and property damage, which can easily climb to tens of thousands of dollars depending on the severity of an accident. Not having adequate car insurance or having a lapse in coverage can be detrimental, even before the new car insurance law goes into effect.

Even after Virginia's new car insurance law is in place, all drivers may still want to have Uninsured/ Underinsured Motorist Coverage (UIM) since there will still be uninsured and underinsured drivers on Virginia roads.

What happens if you drive without car insurance in Virginia after July 1st, 2024?

Virginia drivers found uninsured and falsely certifying that they have insurance by the DMV face stiff penalties. In addition to suspension of all driver and registration privileges, penalties include paying a $600 noncompliance fee, a $145 reinstatement fee, and filing proof of insurance and financial responsibility (form SR-22) for three years.

Full car insurance coverage in Virginia

There are several full car insurance options available from most Virginia carriers. When shopping for car insurance, rate should not be your only criterion for buying coverage. You can and should, however, lower your car insurance rates by keeping a good driving record and avoiding claims.

Optional auto insurance coverages in Virginia:

- Collision: This coverage pays for damages that result from a collision with another vehicle or stationary object.

- Comprehensive: This pays for damages to your vehicle in non-collision circumstances. It covers perils such as theft and damage related to weather events and deer collisions.

- Guaranteed Asset Protection Insurance: Sometimes referred to as gap coverage, this coverage can pay the difference between what you owe on a loan and your car’s actual cash value. This can help if you owe more than your car is worth and your car is stolen or totaled from damage.

-

Uninsured/Underinsured Motorist Coverage: This can pay for your medical bills if someone crashes into you and they do not have liability insurance or not enough. It also can pay lost wages if you cannot work, funeral expenses, pain and suffering, and vehicle damage.

- Medical Payments: In the event of an accident, this coverage goes towards paying for medical expenses for the policyholder and passengers.

- Rental Car Reimbursement: If your car cannot be driven, this coverage can help pay for a rental car until yours can be repaired.

- Roadside Assistance: Roadside assistance can help with roadside troubles such as flat tires, dead batteries, and towing.

How much car insurance do I need in Virginia?

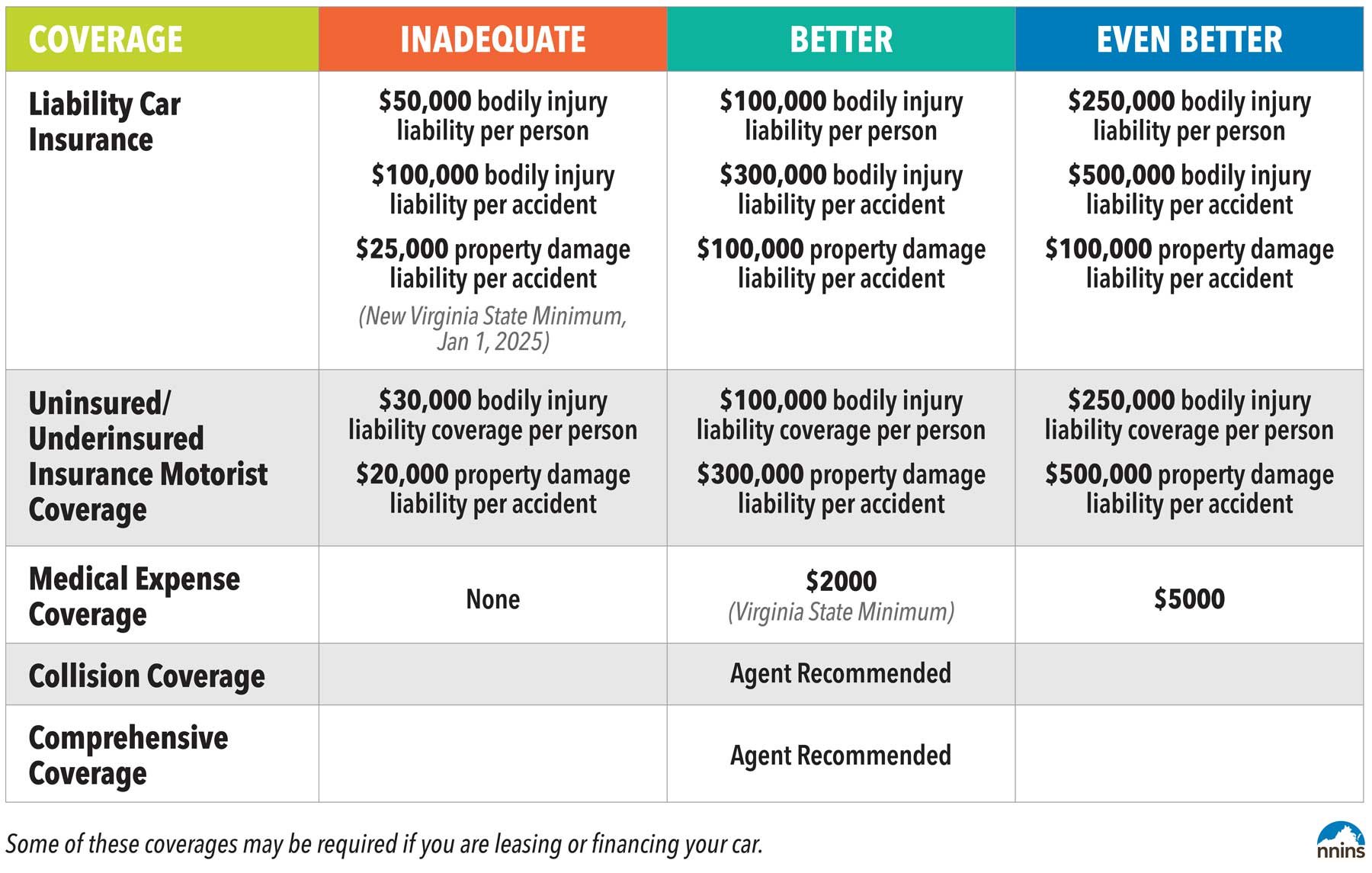

Jennifer, one of our independent agency partners at GLM Insurance in Richmond, helped us create a comparison chart that can help you determine how much car insurance you need. We highly recommend discussing your situation with a local insurance advisor before deciding. Keep in mind that these optional coverages may be required if you lease or finance your car.

Jennifer, one of our independent agency partners at GLM Insurance in Richmond, helped us create a comparison chart that can help you determine how much car insurance you need. We highly recommend discussing your situation with a local insurance advisor before deciding. Keep in mind that these optional coverages may be required if you lease or finance your car.

In 2022, 12.1% of all drivers were uninsured in Virginia, increasing from 9% in 2021. Supporters of Virginia's new car insurance law believe it will save drivers money on their car insurance by reducing the number of uninsured drivers on Virginia roads and preventing litigation and lawsuits.

THE NORTHERN NECK INSURANCE INTEGRITY PROMISE — We pledge to provide straight talk and good counsel from our NNINS Virginia insurance experts through our blog. While we hope you find this helpful source of information, it does not replace the guidance of a licensed insurance professional, nor does it modify the terms of your Northern Neck Insurance policy in any way. All insurance products are governed by the terms in the applicable insurance policy.