You do not have to have renters insurance by law in Virginia. But you will find many landlords require it when you sign a new lease. Even if they don't, consider the advantages of renters insurance. Every dollar counts, which is why renters insurance should be a no-brainer for most people. For pennies a day, you are protecting yourself against theft, fire, and liability losses that could quickly run into the thousands of dollars.

Take my friend, Chris. Chris moved into a new apartment. His landlord required renters insurance. The cost of the policy was $18 a month. Shortly after moving in, he noticed his bathroom didn't have a towel bar or toilet paper holder. Since it was new construction, he was the first tenant. He didn't want to bug his landlord, so he purchased a towel bar and holder himself and hung them up.

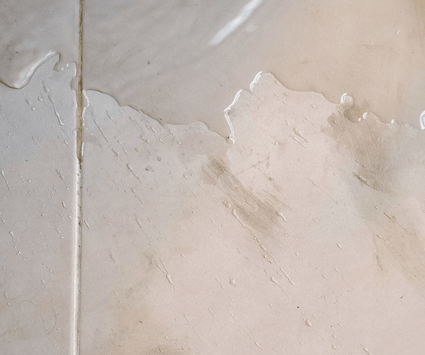

The next day, he noticed a small puddle of water on the bathroom floor. Thinking it must have leaked out from his shower, he soaked it up and forgot about it. But small amounts of water returned day after day and prompted him to contact his building manager to check his toilet. Upon inspection, the repairman found the water was coming from plumbing pipes pierced by the screws from his new toilet paper holder. It also had caused extensive water damage to the empty apartment next door. The total loss, estimated to be over $5,000, would have been his responsibility. Instead, his renters insurance covered it.

What Does Renters Insurance Cost?

Renters insurance in Virginia costs about fifteen dollars a month for $10,000 in personal property coverage and $100,000 in liability, give or take. You can adjust the coverage to suit your needs. A local agent in your area can shop around for you for the best fit. The best fit equals adequate coverage and what you can afford. There are policy limits (the maximum your policy would payout on a claim) and deductibles (your out-of-pocket for a claim). Deductibles vary anywhere from $250 to $1000.

Renter's insurance costs may vary depending on whether you rent in rural Virginia like Charlottesville, Lynchburg, or Roanoke or rent in more high-risk suburban and urban areas like Richmond, Stafford, or Manassas. There also may be differences in costs for policies in some coastal areas, like Virginia Beach, because those areas are more prone to hurricane damage.

What Does Renters Insurance Cover?

Renters insurance provides liability for damage you may cause as you saw with Chris. But it also provides broad protection against the most common threats like fire and theft. It covers your stuff from almost anything (lightning, windstorms, hail, smoke, vandalism).

For instance, imagine Chris's water leak fiasco had somehow ruined his laptop. His renters insurance would cover that loss of property as well so he could repair or replace it. Even if your property's damage came from your neighbor or a problem in your apartment, your landlord would not pay for your stuff. If your neighbor had a fire that went through the wall and ruined your furniture, you would need renters insurance to replace your things.

The cool thing is the liability follows you, not your apartment. Not to pick on poor Chris, but say he bumped into a jogger in the neighborhood, and she fell and twisted her ankle. Renters insurance would pay for those injuries and help her get back on her feet.

So how about protection for when bad stuff happens for a nominal price? Talk to a local agent in your community. They provide important details, help you save money, answer your questions, and shop for the best fit for you.